Workers' compensation insurance for personal care businesses

Workers’ compensation insurance

Workers’ compensation insurance covers medical costs and lost wages for work-related injuries and illnesses. This policy is required in almost every state for businesses that have employees.

Workers' comp protects employees at your beauty salon or spa

Whether you’re a barber, an esthetician, or the owner of a nail salon, it’s always possible for an employee to become injured at work. Wet floors, tangled cables, and uneven flooring can all lead to major injuries, medical bills, and downtime.

Workers’ compensation insurance can pay for an injured worker’s medical expenses and part of the wages lost while they recover. Sole proprietors might also decide to buy this coverage for financial protection against work injuries.

Workers' compensation can help pay for an injured employee’s:

- Immediate medical costs, including emergency room expenses

- Ongoing medical costs, such as physical rehabilitation

- Disability benefits while an employee is unable to work

Workers' comp protects personal care business owners

Typically included in a workers’ comp policy, employer’s liability insurance provides protection when an employee decides to sue a business owner over an injury.

Employer’s liability insurance can help cover:

- Attorney’s fees

- Court costs

- Settlements

Without insurance, you could find yourself paying for a costly legal defense, even if you’re not found liable.

How much does workers' comp cost for personal care businesses?

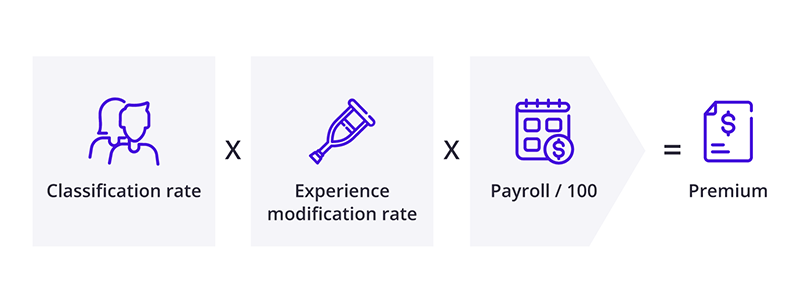

The amount you pay for workers’ compensation is a specific rate based on every $100 of your business’s payroll. Your premium is determined by the type of work done by your employees (classification rate), your experience modification rate (claims history), and your payroll (per $100).

The formula providers use in underwriting to calculate workers' comp rates is:

State laws set workers' comp requirements for personal care businesses

Each state has its own laws for workers’ compensation requirements. For example, every personal care business in Massachusetts is required to carry workers’ comp insurance for its employees, including part-time workers. However, Alabama businesses only need to carry this policy when they have five or more employees.

While independent contractors, sole proprietors, and partners aren't required to carry workers’ compensation insurance, you can purchase a policy to protect yourself, too. It's a wise decision considering the potentially high cost of medical bills from a work injury, which health insurance might refuse to cover.

Workers' compensation laws in your state

Monopolistic state funds for workers’ compensation

In certain states, personal care companies must purchase coverage through a monopolistic workers' comp state fund. Those states are:

If you purchase workers’ comp through a monopolistic state fund, it might not include employer’s liability insurance. However, you can purchase it as stop gap coverage from a private insurance company.

Lower workers' comp costs with risk management

If a hairstylist slips on the wet floor at a shampoo station and suffers an injury, it could lead to an insurance claim. Whether you’re the owner of a day spa or a hair salon, you can create a safer work environment with:

- Employee safety training

- Prompt cleanup of spills

- Proper equipment, such as gloves

By managing your risks, you can decrease workplace injuries. That means fewer claims – and potentially a lower insurance premium.

Top personal care businesses we insure

Don't see your profession? Don't worry. We insure most businesses.

Important policies for personal care businesses

Workers' compensation insurance offers protection for your employees and to some extent your business, but it doesn’t provide coverage for all risks. Owners of personal care businesses should also consider:

General liability insurance: This policy covers legal expenses related to third-party bodily injuries, property damage, and advertising injuries such as libel.

Business owner’s policy (BOP): A BOP combines general liability coverage with commercial property insurance, usually at a lower rate than if the policies were purchased separately.

Professional liability insurance: Also known as errors and omissions insurance (E&O), this policy covers legal costs related to professional mistakes, such as an unsatisfactory haircut.

Cyber insurance: This policy helps businesses recover financially from data breaches and cyberattacks. It's strongly recommended for any business that handles credit cards, email addresses, or other personal information.

Commercial auto insurance: This policy covers the cost of an accident involving a vehicle owned by your personal care business. Most states require this coverage for business-owned vehicles.

Get free quotes and buy online with Insureon

Are you ready to protect your personal care company with workers’ compensation insurance? Complete Insureon’s easy online application today to compare quotes from top U.S. carriers. Once you find the right policy, you can begin coverage in less than 24 hours.